Tax-Free Casinos Explained

Tax-free casinos are gambling online sites where players can enjoy their winnings without having to pay taxes on them. This is especially appealing to players who gamble at the best online casinos and want to maximise their profits. However, it's important to note that even if the casino itself is tax-free, players may still be liable for taxes in their home country depending on local laws.

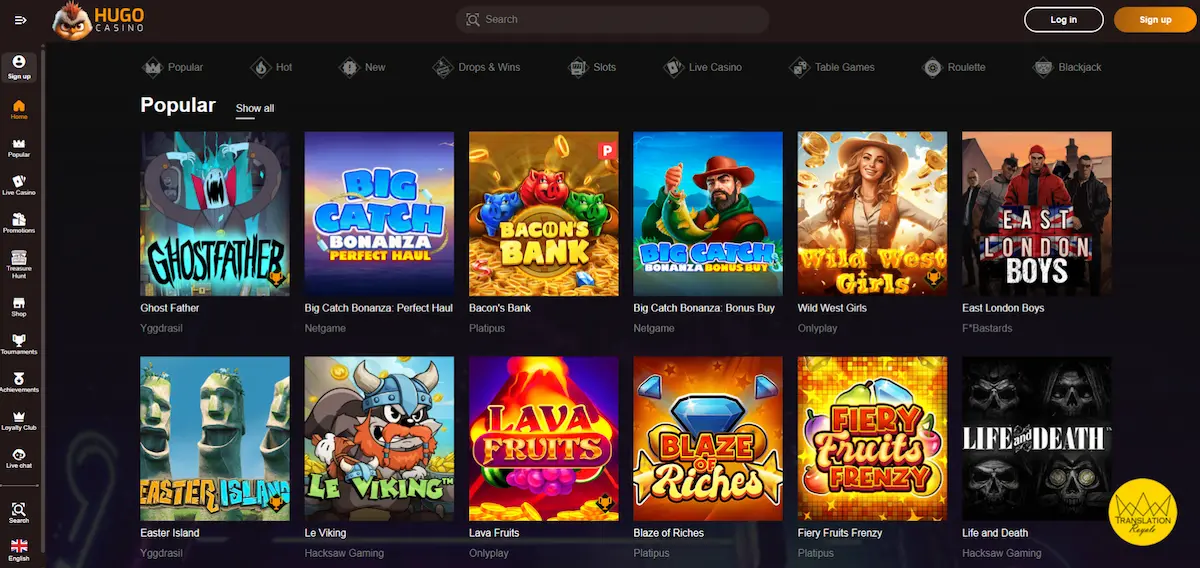

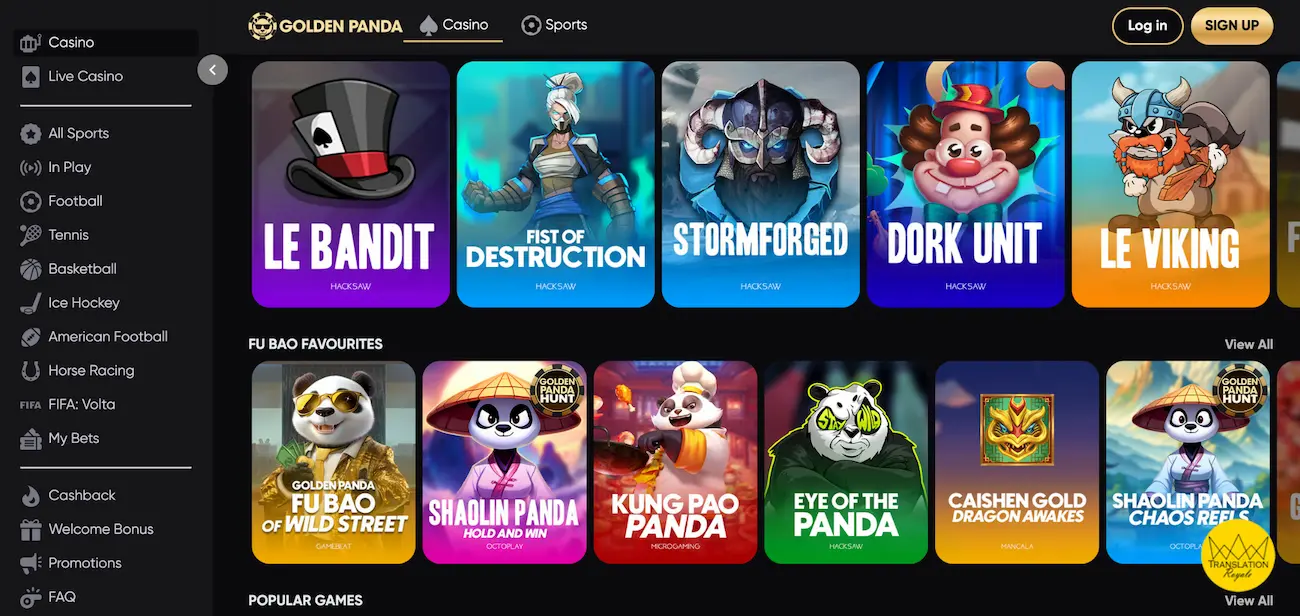

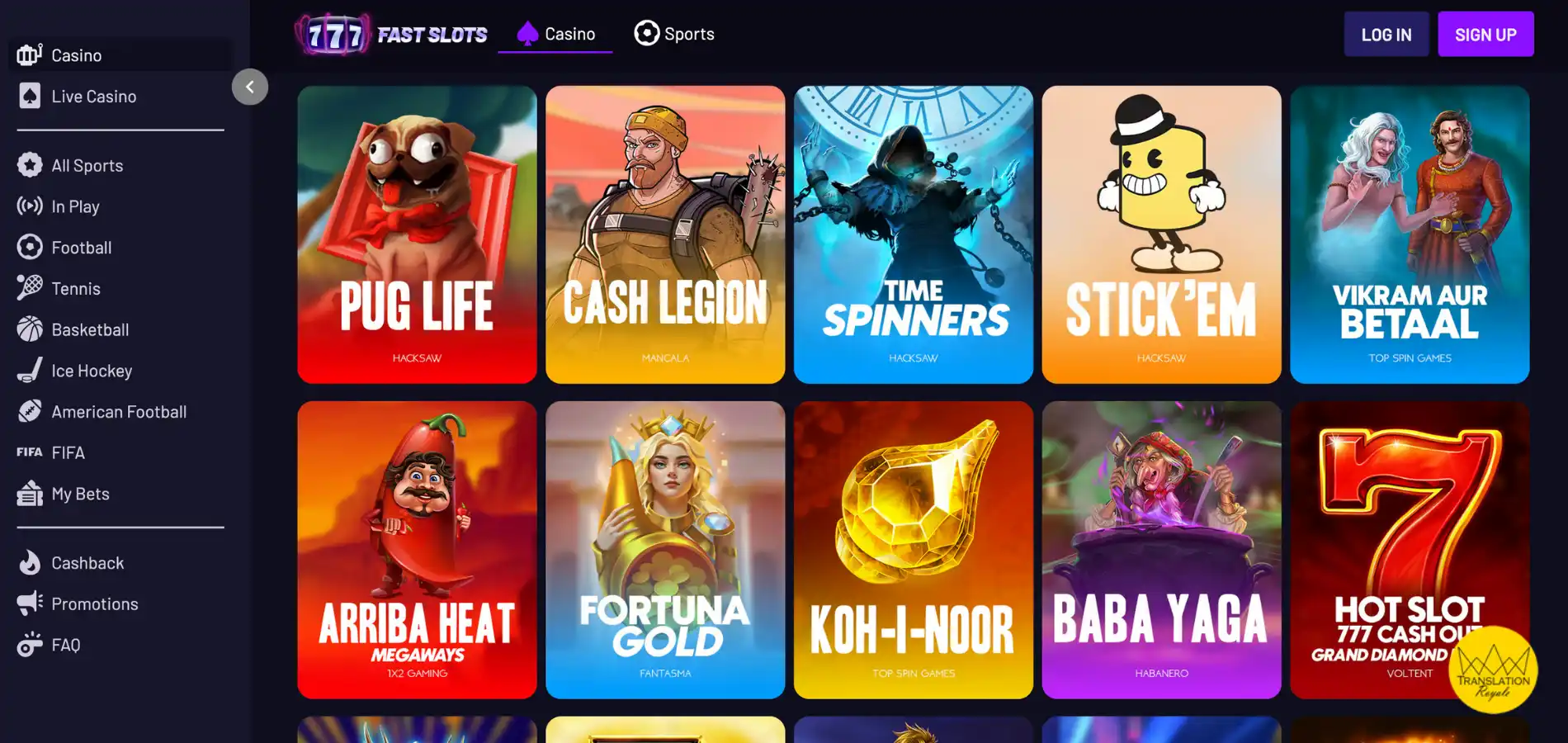

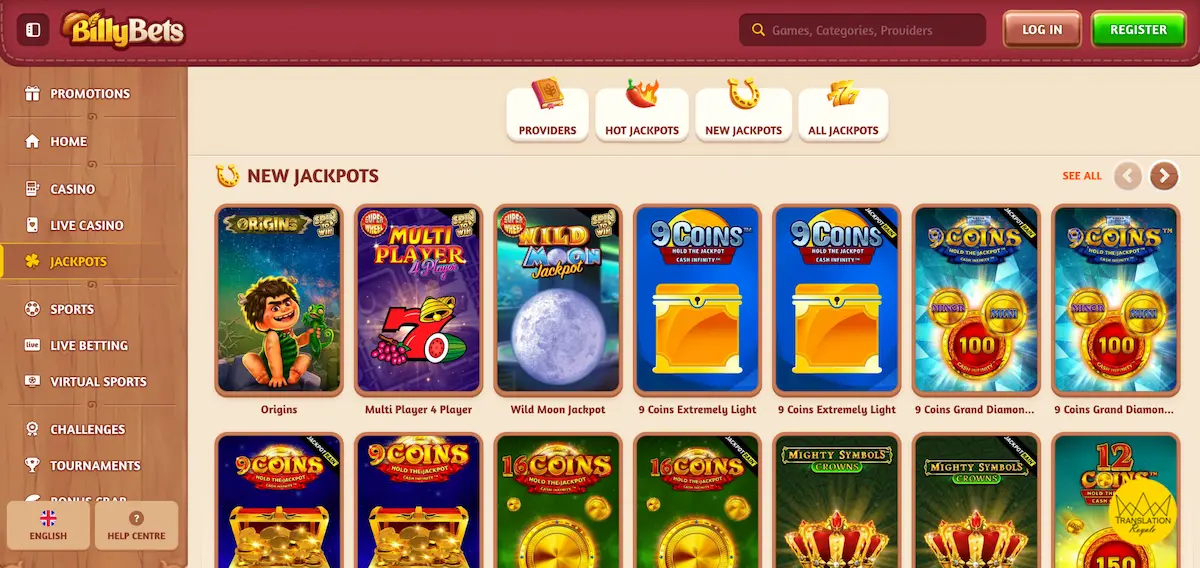

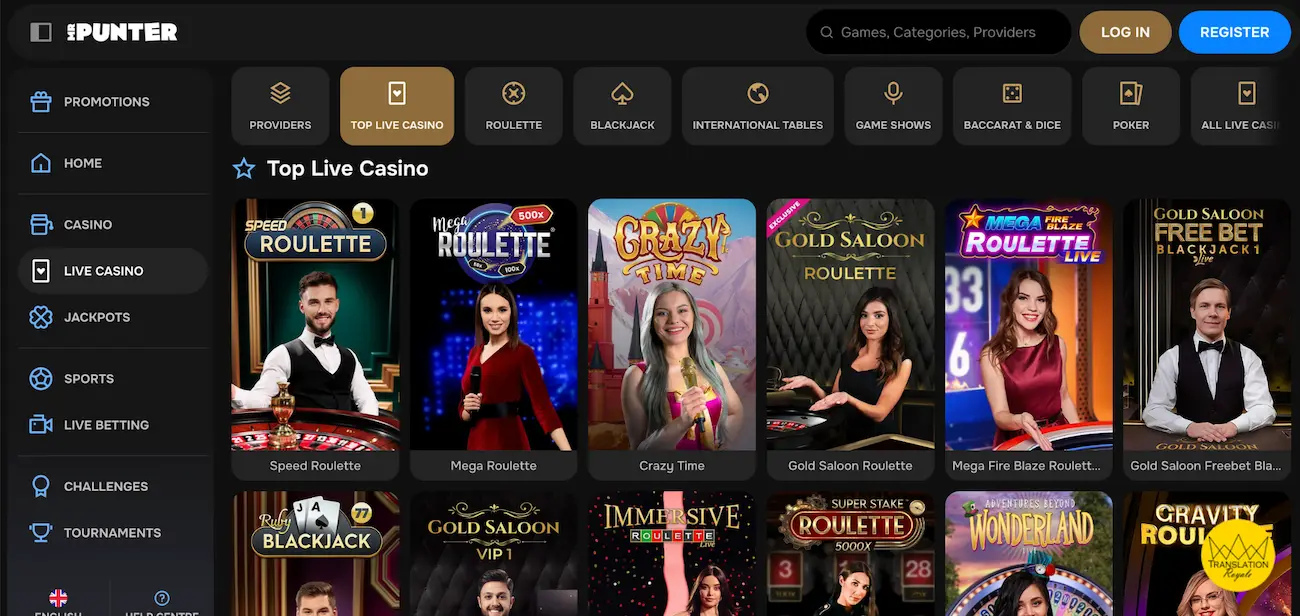

In order to secure tax-free winnings, MGA-licensed casinos are a popular choice here. They're based within the EU, follow strict regulatory and tax compliance standards, and still offer the freedom that some locally-regulated platforms may lack. They also support euro transactions and multiple languages, which makes the transition seamless for European players. Another popular choice is top-tier VPN-friendly online casinos, which allow players to access a wider variety of international platforms while maintaining privacy and bypassing regional restrictions.

Are Online Casino Winnings Taxable in the EU?

Whether online casino winnings are subject to tax in the European Union depends on where you live and where the casino operates. The EU itself does not impose a unified tax policy on gambling income; instead, taxation is governed at the national level. However, EU law, particularly the principle of free movement of services, or more specifically Article 56 of the Treaty on the Functioning of the European Union, does influence how member states can tax gambling income, especially from operators licensed in other EU/EEA countries. The European Court of Justice (ECJ) has ruled in several cases (e.g., Gambelli, C-243/01 and Ladbrokes, C-258/08) that member states must not discriminate against EU-licensed gambling operators without valid justification. In effect, if your country exempts domestic winnings from tax, they generally must do the same for winnings from EU-licensed sites.

How Taxation Varies Across the European Union

Winnings from online casinos licensed within the EU or EEA, such as those regulated by the Malta Gaming Authority (MGA) or Estonia's EMTA, are generally tax-free for recreational players residing in EU member states, due to the EU's principle of free movement of services. However, this exemption may not extend to international casinos licensed outside the EU/EEA, such as those operating under licences from Curacao, Anjouan), or Costa Rica.

Some EU countries, including Germany, France, Sweden, and the Netherlands, may require players to declare and pay tax on their winnings. A few jurisdictions, such as Ireland and the United Kingdom, do not impose personal income tax on gambling winnings regardless of the casino's location. Nonetheless, professional gamblers or individuals with frequent or substantial wins may face different tax obligations compared to casual players.